January 2021 Silicon Valley Market Update

As your local real estate experts, we feel it’s our duty to give you, our valued client, all the information you need to better understand our local real estate market. Whether you’re buying or selling, we want to make sure you have the best, most pertinent information, so we’ve put together this monthly analysis breaking down specifics about the market.

As we all navigate this together, please don’t hesitate to reach out to us with any questions or concerns. We’re here to support you.

All our best,

Maya and Jason

Welcome to our January newsletter. This month, we cover the state of employment in the United States and the likelihood of meaningful stimulus. We also dive into how the Democratic Party’s majority control over both chambers of Congress and the White House could affect asset prices and interest rates.

Most of California (around 98% by population) is under a stay-at-home order due to COVID-19, and the United States as a whole is seeing new peaks every day. With the approval of several vaccines, we finally have a glimmer of hope to move out of the pandemic. However, we know that transmission mitigation measures will still be necessary through 2021 at least. The pandemic has substantially raised demand for housing, and we suspect that demand will continue through this year. Mortgage rates remain at all-time lows, and buyers are devoting more of their total spending to housing costs.

As we enter the new year, we continue to provide you with the most up-to-date market information so that you feel supported and informed in your buying and selling decisions.

In this month’s newsletter, we cover the following:

Key Topics and Trends in January

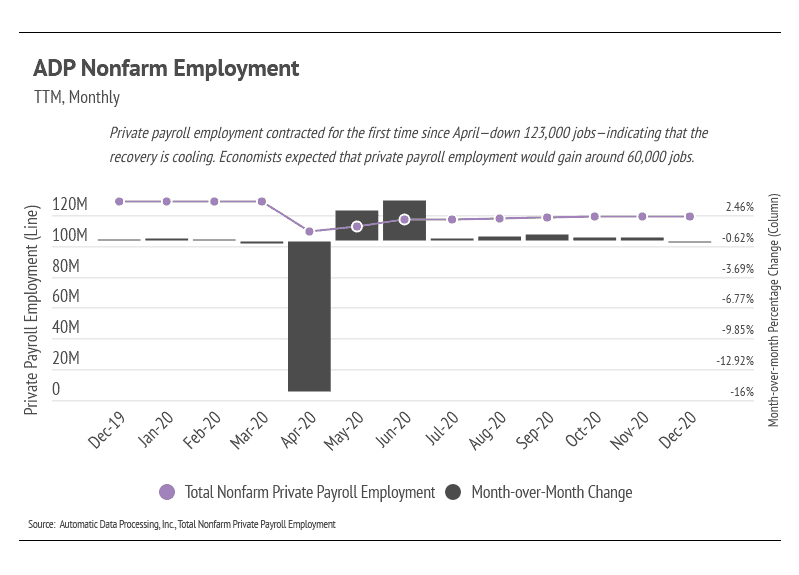

According to the ADP private payrolls, the U.S. lost 123,000 jobs in December 2020, marking the first contraction since April. Economists predicted an increase of around 60,000 jobs in December. However, they did not anticipate larger companies, especially in leisure and hospitality, laying off employees due to reimplementation of stricter COVID-19 restrictions.

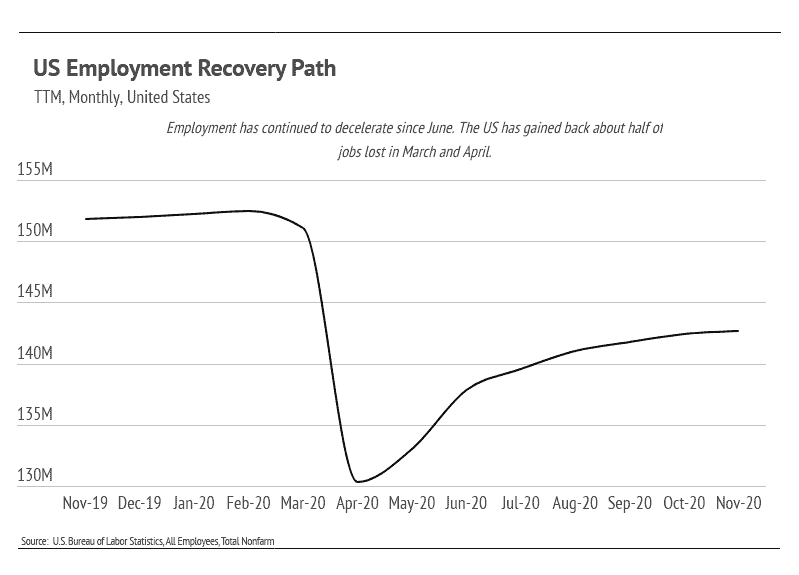

Data from the Bureau of Labor Statistics differs in the exact numbers but shows the obvious deceleration in employment growth. As time passes, more and more jobs will be permanently lost, likely with real long-term economic impact: fewer people interacting in the economy usually indicates less buying, which trickles into less production, which trickles into fewer workers needed, leading to more unemployed workers.

Job growth is one of the clearest indicators of economic health, so the December jobs contraction underscores a slowing of the recovery and the need for government stimulus. Under the incoming presidential administration, government stimulus is far more likely but will take some time to implement. With aid, businesses will be able to continue operating and will likely be able to hire significant numbers of employees back, setting the recovery back on course.

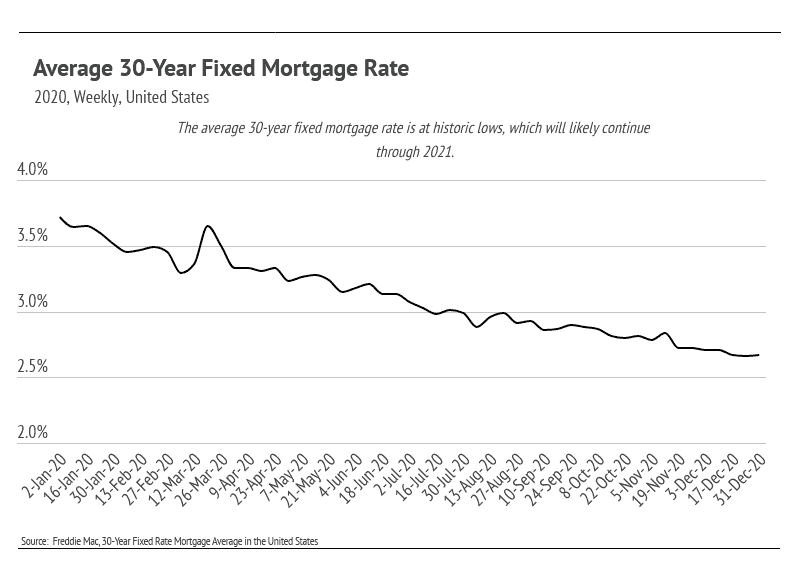

To help struggling businesses and people, the government will have to spend significant amounts of money. Heavy fiscal spending is often associated with higher inflation. Currently, inflation is around 1.2% (the Federal Reserve targets 2%), and with the expected increase in government spending, the expected inflation will rise as well. Ultimately, money today is worth more than money in the future. Not only can you buy more today, but real interest rates (inflation-adjusted interest rates) will be lower as well, making a home bought today cost less than its future price.

For example, the average 30-year mortgage rate is 2.67%, and if the inflation rate were 2%, the real interest rate on the mortgage would be 0.67%.

The financial circumstances on the individual level are highly variable, now more than ever. Those who have been unaffected (or even positively affected) financially are likely saving more money than ever. Strict COVID-19 restrictions have largely cut travel, dining, and entertainment expenses, allowing potential home owners to devote more of their income toward buying a home that they love. With historically low mortgage rates and an expected increase in inflation, it’s never been cheaper to finance a home.

Demand shows no sign of decline in the near term. Today, housing is one of the best investments one can make, as it has been historically.

January Housing Market Updates for Silicon Valley

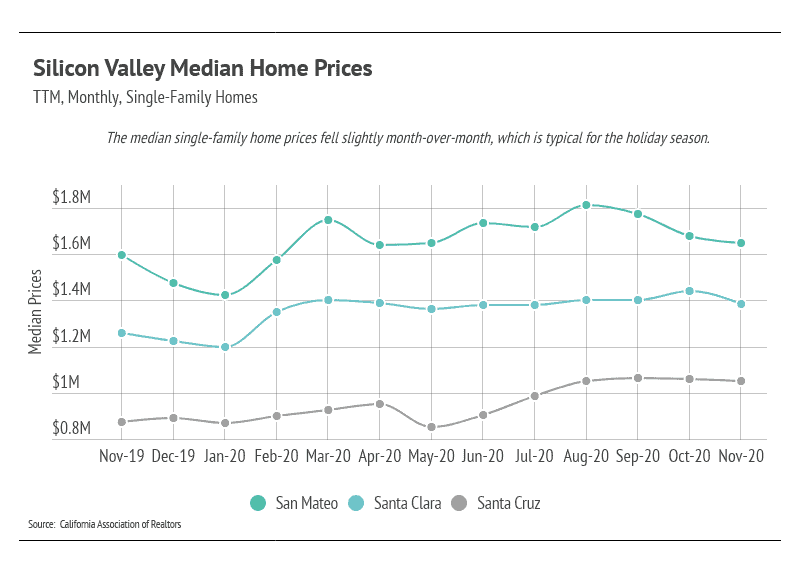

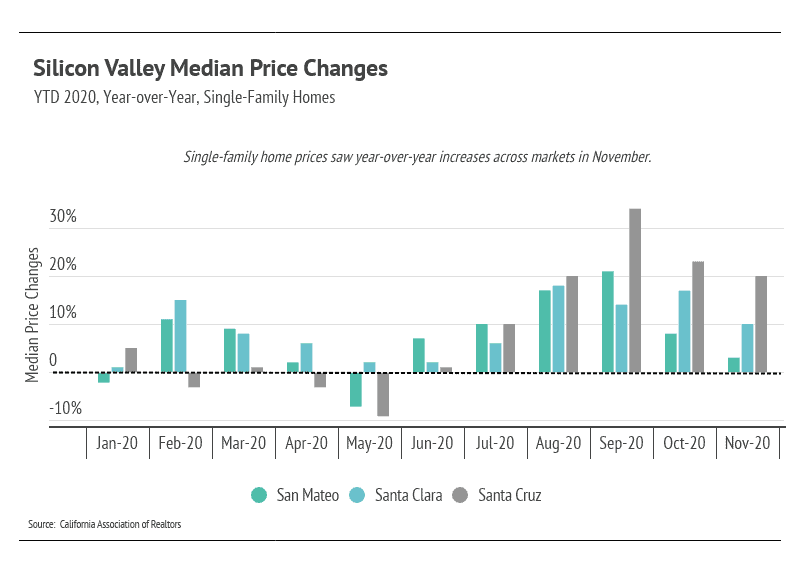

The median single-family home price declined slightly month-over-month, which is normal for the late autumn season. Year-over-year, single-family home prices increased considerably in San Mateo and Santa Cruz, up 10% and 20%, respectively. Inventory has continued to decline, as fewer homes have come to market and sales have remained high, contributing to the price increases.

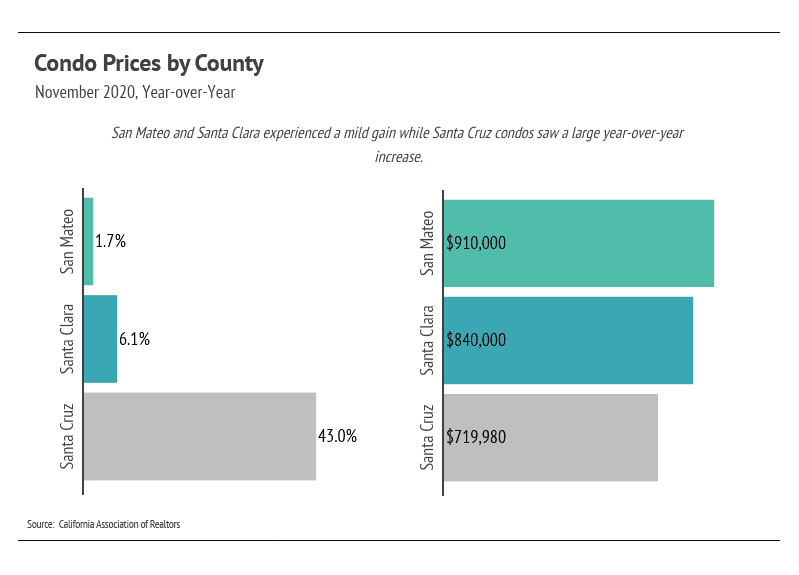

As you can see in the graph below, median condo prices were up across counties. Santa Cruz had an exceptionally large year-over-year median price increase.

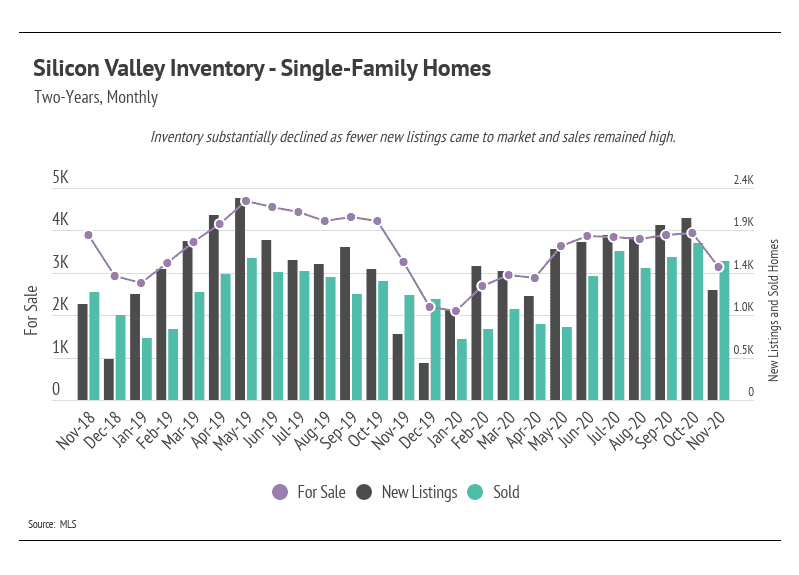

Single-family home inventory was lower through 2020 relative to 2019. Home sales climbed after the initial months of the pandemic (March through May). Generally, buyers and sellers left the market in April and May, causing pent-up demand. Since June, sales have increased and showed unseasonably high levels in November 2020 for both single-family homes and condos. Usually, we expect sales to decline in the autumn and winter months, but homes were selling at extremely high rates. We can attribute this to fewer holiday obligations in 2020, allowing more focus on home buying. Single-family home inventory dropped in November due to unusually high sales numbers, and it is likely to decline further as we make our way through the winter months.

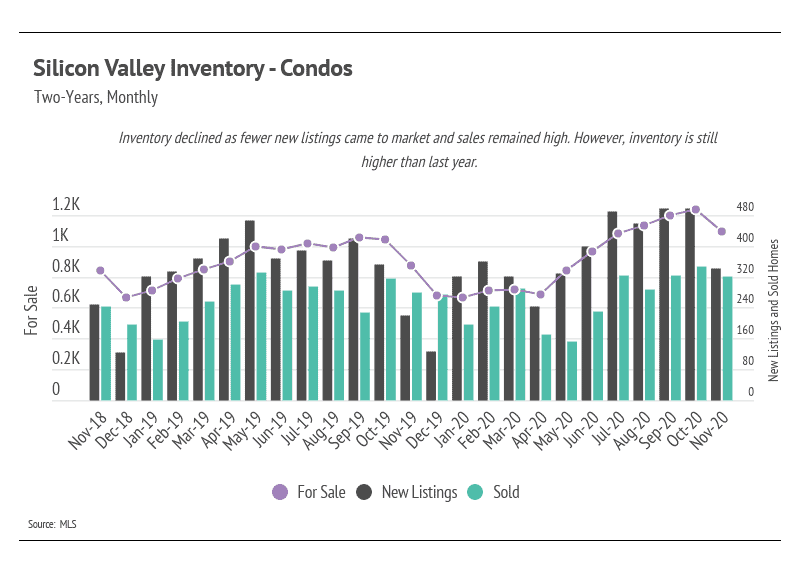

The number of condos on the market declined significantly in November. Fewer new listings came to market, and sales inched nearly as high as new supply.

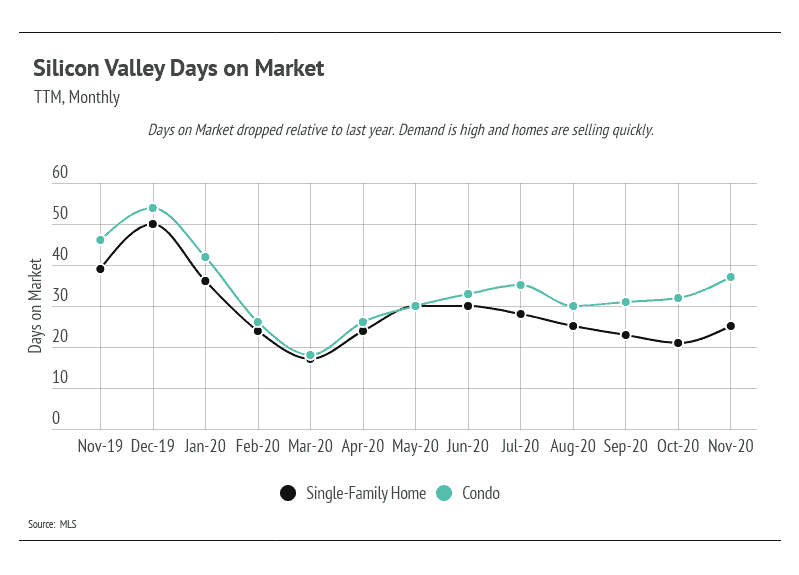

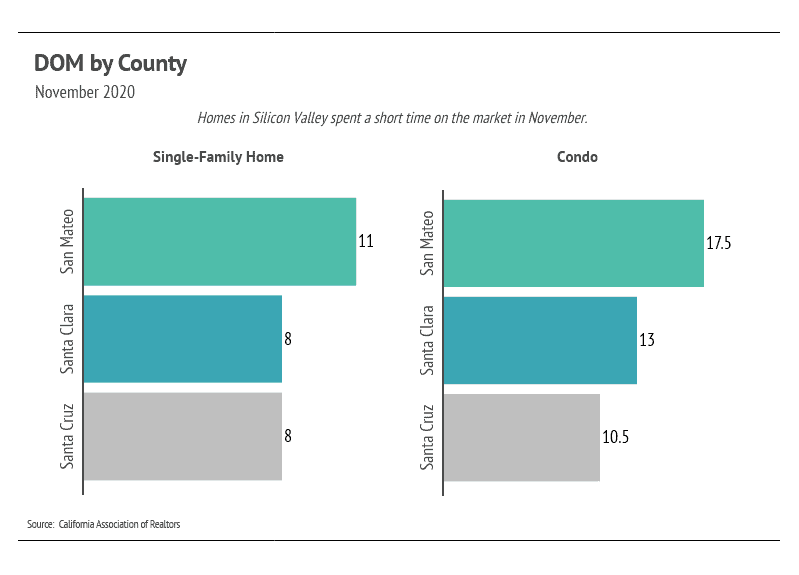

Days on Market (DOM) was higher in December, which is attributed to sold homes that have been on the market for longer than average. Normally, rising DOM indicates a slowing market, but that is not the case for Silicon Valley. Inventory built to a level that demand could not meet, so homes stayed on the market longer than usual. As we will see, the pace of sales affects Months of Supply Inventory (MSI) and has contributed to the low MSI over the past several months.

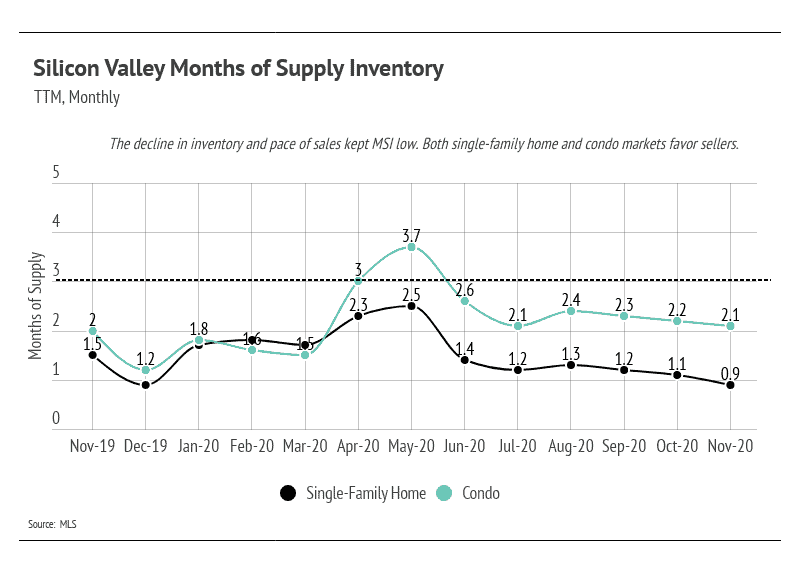

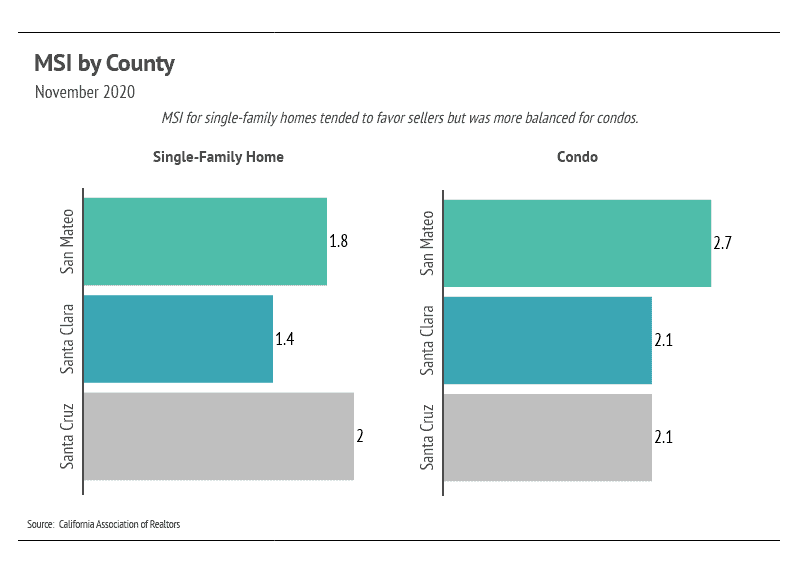

We can use MSI as a metric to judge whether the market favors buyers or sellers. The average MSI is three months in California (far lower than the national average of six months of supply), which indicates a balanced market. An MSI lower than three means that buyers dominate the market and there are relatively few sellers (i.e., it is a sellers’ market), while a higher MSI means there are more sellers than buyers (i.e., it is a buyers’ market). The MSI dropped below one for single-family homes, which firmly favors sellers. The MSI for condos also declined to 2.1, indicating a sellers’ market as well.

In summary, the high demand in Silicon Valley has sustained home prices. Inventory for single-family homes and condos will likely decline further into the new year, and fewer sellers will likely come to market, potentially lifting prices higher. Overall, the housing market has shown its resilience through the pandemic and remains one of the safest asset classes. The data show that housing has remained consistently strong through this period.

We anticipate new listings to slow through the holiday months. The autumn/winter season tends to see a slowdown in activity, although we did see a new trend toward the end of 2020 with higher-than-normal sales.

As always, we remain committed to helping our clients achieve their current and future real estate goals. Our team of experienced professionals are happy to discuss the information we’ve shared in this newsletter. We welcome you to contact us with any questions about the current market or to request an evaluation of your home or condo.

Seasonality in the housing market was incredibly steady before the pandemic. Prices typically rose from January to June, when inventory was low but rising, and then fl… Read more

The driving force behind the substantial price increases over the past two years has been the supply of homes, or lack thereof. So, will the housing shortage reverse? … Read more

As your local real estate experts, we feel it’s our duty to give you, our valued client, all the information you need to better understand our local real estate market… Read more

Happy early Thanksgiving! Please read below our market update for the month of November. In addition, as your local real estate experts, we feel it’s our duty to give … Read more

Welcome to our October newsletter, where we’ll explore residential real estate trends in Silicon Valley and across the nation. This month, we examine the state of the … Read more

During this time of the year, we are starting to enter the Fall market. The market is still very strong with limited inventory in our local markets. Strong sales are s… Read more

Welcome to our August newsletter, where we’ll explore residential real estate trends in Silicon Valley and across the nation. This month, we examine the state of the U… Read more

As your local real estate experts, we feel it’s our duty to give you, our valued client, all the information you need to better understand our local real estate market… Read more

You’ve got questions and we can’t wait to answer them.